In the fast-paced world of day trading, where every millisecond counts, choosing the right infrastructure to support your trading operations is crucial. Whether you’re a professional trader, a hedge fund, or an institution, having reliable, low-latency connections to trading venues and servers can significantly impact your bottom line. MetaNet has emerged as a leading solution for traders who need robust hosting and access to a wide range of financial markets and servers. From Equinix’s NY4 data center to direct connections with major liquidity providers like Currenex, Interactive Brokers, and Clear Street, MetaNet offers the performance, security, and scalability traders with powerful dedicated servers and VPS needed to stay ahead of the competition.

Why Hosting Matters for Day Traders

When it comes to day trading, timing is everything. Markets move quickly, and having the ability to execute orders within fractions of a second can be the difference between profit and loss. A reliable hosting solution ensures that your trading applications run smoothly, without interruptions or delays. But it’s not just about speed; it’s also about security and scalability.

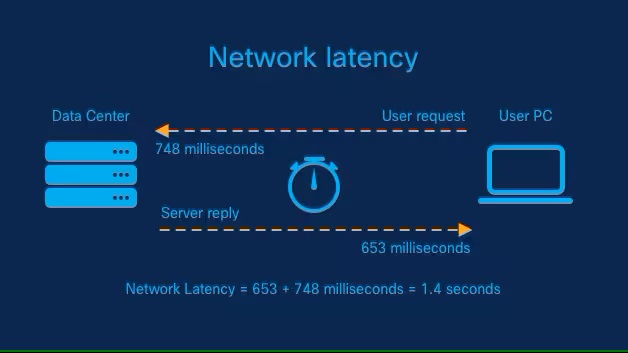

Latency is one of the most critical factors for traders. A delay of even a few milliseconds can cause significant slippage in high-frequency trading strategies. That’s why having a server close to the exchange or liquidity provider is a must. MetaNet understands this need and has strategically positioned itself to offer lightning-fast connectivity to various liquidity providers and exchanges.

Security is another concern, especially when dealing with large sums of money and sensitive financial data. MetaNet ensures that its infrastructure is secure, offering private connections, advanced encryption, and multiple layers of protection to keep your data and trades safe.

Finally, scalability allows traders to adjust their infrastructure as their trading needs evolve. Whether you’re scaling up your algorithmic trading strategies or expanding your trading portfolio, MetaNet offers flexible solutions that grow with you.

Direct Connections to Leading Liquidity Providers

One of the standout features of MetaNet is its ability to connect traders directly to some of the most reputable liquidity providers in the FX market. For day traders, having access to the right liquidity can make or break their strategy. MetaNet offers seamless access to:

- Currenex: Currenex is one of the largest and most well-established platforms for FX trading. With its robust liquidity and real-time execution capabilities, it’s an essential resource for traders looking for reliable and fast access to the global FX market. MetaNet offers a direct connection to Currenex, ensuring that traders can tap into its deep liquidity pool with minimal latency.

- Interactive Brokers: Known for its comprehensive trading platform, Interactive Brokers offers a wide range of products, including FX, stocks, options, and futures. MetaNet’s ability to connect to Interactive Brokers allows traders to access a diverse array of markets, giving them the flexibility to implement a variety of trading strategies.

- Clear Street: Clear Street offers execution and clearing services for institutional investors. It’s an ideal platform for traders seeking to execute large, complex trades with speed and precision. MetaNet’s direct connection to Clear Street provides traders with access to a seamless execution environment for both high-frequency and low-latency strategies.

These direct connections provide MetaNet’s clients with access to some of the best liquidity in the market, ensuring that trades are executed with minimal slippage, and at the most favorable prices possible.

NY4 Equinix: A Hub for Financial Companies

When it comes to financial data centers, Equinix NY4 stands out as one of the most important hubs for traders, brokers, and financial institutions. Located in Secaucus, New Jersey, this data center is strategically positioned to provide proximity to key financial exchanges and liquidity providers. Many of the world’s largest financial companies, including hedge funds, trading firms, and brokers, host their operations in NY4 due to its low-latency access to major financial exchanges in North America.

MetaNet recognizes the importance of low-latency access and has established its own presence in NY4, providing traders with high-performance hosting and connectivity solutions. By hosting trading applications and systems in this high-performance data center, MetaNet ensures that its clients benefit from proximity to key financial markets, including:

- Direct Access to Exchanges: Hosting within NY4 offers traders direct, low-latency access to exchanges like the CME Group, ICE, and NASDAQ, which is crucial for executing high-frequency and algorithmic trades with speed.

- Proximity to Liquidity Providers: Many liquidity providers, such as Currenex and Interactive Brokers, are also located within NY4 or have private connections to the center. This geographical advantage ensures that traders using MetaNet can benefit from reduced latency and quicker execution times.

- Resilience and Redundancy: NY4 is known for its top-tier infrastructure, offering 24/7 support, redundant power supplies, and advanced security measures. MetaNet clients benefit from this resilient infrastructure, minimizing the risk of downtime and ensuring that their trading operations run smoothly.

Lets Take a look at some sample Performance metrics:

Platform: Interactive Brokers

Location: Trumbull, CT

From our NYC location, we consistently see 1.0ms to 2.0ms to Interactive Brokers in Connecticut

Pinging ndc1.ibllc.com [64.190.197.40] with 32 bytes of data:

Reply from 64.190.197.40: bytes=32 time=2ms TTL=248

Reply from 64.190.197.40: bytes=32 time=2ms TTL=248

Reply from 64.190.197.40: bytes=32 time=2ms TTL=248

Reply from 64.190.197.40: bytes=32 time=2ms TTL=248

Interactive Brokers uses Akamai CDN. We are just 1 hop to Akamai which is located at our NYIIX Peering Exchange, and Akamai is the CDN IB subscribes to, and our traffic will not traverse over the public internet to get there which lowers latency and makes for a stable connection as there are not a lot of hops.

Example: Metanet servers and VPS need to make only 1 hop into Akamai’s network where it is carried over to the Interactive Brokers servers:

Tracing route to ndc1.ibllc.com [64.190.197.40]

over a maximum of 30 hops:

1 1 ms 1 ms 1 ms 192.225.162.193

2 * * * Request timed out.

3 1 ms 1 ms 1 ms akamai-ic-376000.ip.twelve99-cust.net [62.115.170.19]

4 1 ms 1 ms 1 ms po110.bs-b.sech-lga.netarch.akamai.com [23.57.97.245]

5 1 ms 1 ms 1 ms a72-52-1-149.deploy.static.akamaitechnologies.com [72.52.1.149]

6 1 ms 1 ms 1 ms ae121.access-a.sech-lga.netarch.akamai.com [23.57.97.251]

7 1 ms 1 ms 1 ms 93.191.172.156

8 2 ms 2 ms 2 ms a69-192-172-174.deploy.static.akamaitechnologies.com [69.192.172.174]

9 2 ms 2 ms 2 ms ndc1.ibllc.com [64.190.197.40]

It should be noted that for all these cases since the public internet is being used and the connection is not a private line to the broker, it is subject to congestion and conditions of the Internet. Nevertheless as we directly connect to the carrier exchange where IB is located there is almost no transmission over public internet and the entire traffic transfer to Akamai takes places solely inside our data center at the Peering Exchange. This same service is also available over our IP Transit for Colocation customers as well, in the event a Hosting ISP leases data center space from us, for their FXCM VPS clients, or for customers such as developers who want to use their own server hardware.

Private Connections: A Competitive Edge for Traders

For traders and institutions that require even greater reliability and performance, MetaNet offers private connections to its liquidity providers and exchanges. A private connection eliminates the uncertainty and delays associated with public internet traffic, ensuring a direct, dedicated line to the financial markets.

Private connections offer several advantages:

- Reduced Latency: By bypassing the public internet, private connections provide faster, more reliable access to trading venues and liquidity providers. This reduction in latency is critical for high-frequency and algorithmic traders who rely on split-second decisions.

- Increased Security: Private connections offer enhanced security compared to public internet connections. This is particularly important for traders handling sensitive financial data or executing high-value trades.

- Improved Reliability: Private connections ensure a more stable and consistent trading environment, with fewer disruptions or interruptions due to network congestion or external issues.

MetaNet’s private connectivity options are ideal for institutional traders or those managing large volumes of trades, as they provide a more secure and efficient way to access the markets.

Why Choose MetaNet?

MetaNet stands out in the crowded world of hosting solutions for traders due to its unique combination of low-latency access to major liquidity providers, world-class data center infrastructure, and private connectivity options. Here’s why it’s an excellent choice for traders:

- Seamless Connectivity to Top Liquidity Providers: With direct connections to Currenex, Interactive Brokers, Clear Street, and more, MetaNet ensures that traders have fast and reliable access to a broad range of financial markets.

- Strategic Hosting in NY4 Equinix: The proximity to key financial exchanges and liquidity providers makes MetaNet a competitive choice for traders who need the best possible performance and reliability.

- Private Connections for Maximum Performance: For traders who demand the highest level of performance, MetaNet’s private connectivity options ensure low-latency, secure, and reliable access to markets.

- Scalability and Flexibility: Whether you’re a retail trader or an institutional investor, MetaNet’s hosting solutions can scale to meet your needs as your trading operations grow.

- Security and Resilience: With top-tier security features and infrastructure, MetaNet ensures that your trading operations remain safe and operational 24/7.

MetaNet’s M2 NVMe SSD-based Dedicated Server Lineup: Minimizing Latency for Optimal Performance

MetaNet offers both low-cost VPS solutions and affordable bare-metal dedicated servers for traders who need the best infrastructure to optimize their trading strategies. When deciding between VPS and dedicated servers, traders must consider the trade-offs between cost and performance.

- VPS (Virtual Private Servers): VPS solutions are ideal for traders who need an affordable option, but the shared environment can introduce latency and potential instability during periods of heavy resource usage. Traders with more demanding latency requirements often opt for dedicated servers to ensure consistent performance.

- Dedicated Servers: MetaNet’s bare-metal dedicated servers ensure that all resources are dedicated exclusively to you, providing predictable and low-latency performance. Dedicated servers are essential for traders running high-frequency algorithms or trading on platforms that require optimal resource allocation.

Latency is not only dependent on your internet connection, but also on the hardware performance of your server. MetaNet’s M2 NVMe SSD-based dedicated server lineup is optimized for the fastest possible processing speeds, with PCIe-based RAM chips that connect directly to the CPU, minimizing delays and ensuring your trades are executed as quickly as possible.

VPS vs. Dedicated Servers: Choosing the Right Option for Your Trading Needs

When selecting a hosting solution, traders often face a choice between VPS and dedicated servers. MetaNet offers both options, each with distinct advantages depending on your needs.

- VPS (Virtual Private Server): A VPS is an affordable option where multiple users share the same physical server. The major benefit of a VPS is cost-effectiveness, allowing traders to run their trading applications without the high cost associated with dedicated servers. However, because the resources of a VPS are shared among other users, performance can sometimes be affected by “noisy neighbors”—other virtual machines running on the same physical hardware. This can lead to fluctuations in latency, especially during peak usage periods.

- Dedicated Servers: On the other hand, MetaNet’s bare-metal dedicated servers offer traders a dedicated machine for their exclusive use, ensuring maximum performance. Since no other users are sharing the hardware, the server’s resources are entirely at your disposal, resulting in much more predictable latency. This is especially important for traders running high-frequency algorithms or those requiring ultra-low-latency execution. With dedicated servers, there’s no risk of the “noisy neighbor” effect that can disrupt trading performance.

The Role of Hardware in Latency: It’s Not Just the Internet Connection

When traders focus on reducing latency, they often think solely about their internet connection and the distance between their server and the exchange or liquidity provider. While the network connection is crucial, the hardware of the server itself plays an equally important role in latency

. At MetaNet, we’ve chosen high-performance components specifically designed to minimize latency, ensuring that your trading application runs at its peak efficiency.

Latency isn’t just about how fast data travels across the internet; it also depends on how quickly the server can process and deliver that data. A key factor in this process is the storage and memory architecture of the server. If the hardware isn’t optimized, even the fastest internet connection can result in delays.

MetaNet’s M2 NVMe SSD-based server lineup is engineered to offer the lowest latency possible. These high-performance drives feature PCIe-based RAM chips that connect directly to the CPU, bypassing traditional storage bottlenecks. This hardware architecture ensures faster data retrieval and processing, which translates directly into reduced latency for your trading operations. NVMe SSDs are particularly effective for tasks requiring high-speed, low-latency access to large datasets—such as executing trades in real-time.

When you’re executing trades on financial markets, the difference between milliseconds can mean missed opportunities or significant slippage. MetaNet’s advanced hardware ensures that data is processed faster, and trading signals are executed more reliably than with traditional storage solutions.

NYIIX Peering Exchange: Ensuring Direct, Low-Latency Connectivity to Financial Networks

MetaNet isn’t just focused on improving internal hardware performance; we also ensure that our clients enjoy the fastest possible access to external networks. One of the key benefits of MetaNet’s hosting solution is its connection to the New York International Internet Exchange (NYIIX). NYIIX is a premier internet exchange hub located in New York that allows private peering between networks, which is especially advantageous for high-frequency traders and those who need direct, low-latency access to financial liquidity providers.

Unlike traditional public internet traffic that passes through multiple routers and networks, the private peering at NYIIX enables MetaNet to provide secure, high-performance, low-latency connections to major liquidity providers like Currenex, Clear Street, Interactive Brokers, and others. Through NYIIX’s private peering, traffic doesn’t have to traverse the unpredictable public internet, which can introduce packet loss, congestion, and irregular latency—conditions that can disrupt trading strategies.

For example, when connecting to a provider like Clear Street, MetaNet clients can bypass the public internet entirely and instead use the private network within NYIIX. This results in faster, more reliable connections, often with only one hop and less than 1ms latency to reach the provider’s network. With MetaNet’s infrastructure, you can rest assured that your trading connections are both fast and stable, ensuring uninterrupted access to the market.

The MetaNet Advantage for Traders

By offering a combination of low-cost VPS solutions, powerful dedicated servers, and direct connections to major liquidity providers, MetaNet provides a comprehensive solution tailored to meet the needs of traders. Here’s why MetaNet is the right choice for day traders and institutional investors:

- Low-Cost VPS for Budget-Conscious Traders: MetaNet’s affordable VPS solutions give traders a budget-friendly option to run their trading applications with moderate performance requirements. For traders on a tight budget, a VPS can be an excellent way to access trading resources without breaking the bank.

- Dedicated Servers for High-Performance Trading: For traders who demand consistent, predictable low-latency execution, MetaNet’s bare-metal dedicated servers deliver superior performance. By providing dedicated hardware exclusively for your use, MetaNet ensures that latency is minimized, even during peak usage periods.

- Advanced Hardware with NVMe SSDs: The M2 NVMe SSD-based server lineup is optimized for low-latency performance, with PCIe-based RAM chips that connect directly to the CPU for faster data processing. This advanced architecture ensures that your trading operations run smoothly, even under heavy data load.

- Direct Connectivity via NYIIX Peering Exchange: MetaNet’s connection to NYIIX provides private, low-latency peering with liquidity providers like Currenex, Clear Street, and Interactive Brokers. By bypassing the public internet, MetaNet ensures fast, reliable access to key financial markets.

- Affordable, Scalable Solutions: Whether you’re running a small personal trading setup or managing a large-scale operation, MetaNet offers flexible solutions that scale with your needs. From low-cost VPS to high-performance dedicated servers, we provide the tools and infrastructure you need to grow your trading business.

- Unmatched Security and Reliability: MetaNet’s infrastructure is built with robust security features and offers 24/7 support to ensure your trading operations are always up and running. With private connections, redundant power supplies, and advanced encryption protocols, your data and trades are always secure.

Conclusion

For traders looking to gain an edge in the highly competitive world of day trading, having the right infrastructure is critical. MetaNet provides an unbeatable combination of performance, scalability, and connectivity to execute strategies with speed, reliability, and security. Whether you need an affordable VPS for light trading or a high-performance dedicated server for high-frequency trading, MetaNet has you covered. With direct access to leading liquidity providers like Currenex, Interactive Brokers, and Clear Street, as well as proximity to the NY4 Equinix data center and private peering at NYIIX, MetaNet ensures that traders have the tools they need for success. With advanced hardware solutions, direct access to liquidity providers, and private peering at NYIIX, MetaNet ensures that your trades are executed as efficiently and securely as possible. MetaNet offers advanced hardware solutions, low-latency private connectivity, and the necessary infrastructure to take your trading operations to the next level. Whether you’re an individual trader or part of a large institution, MetaNet ensures that your trades are executed efficiently and securely. By offering high-performance dedicated servers, low-latency private connectivity, and advanced hardware, MetaNet ensures that your trades are executed as efficiently and securely. For those serious about trading in the financial markets, MetaNet is the clear choice to stay ahead of the competition.